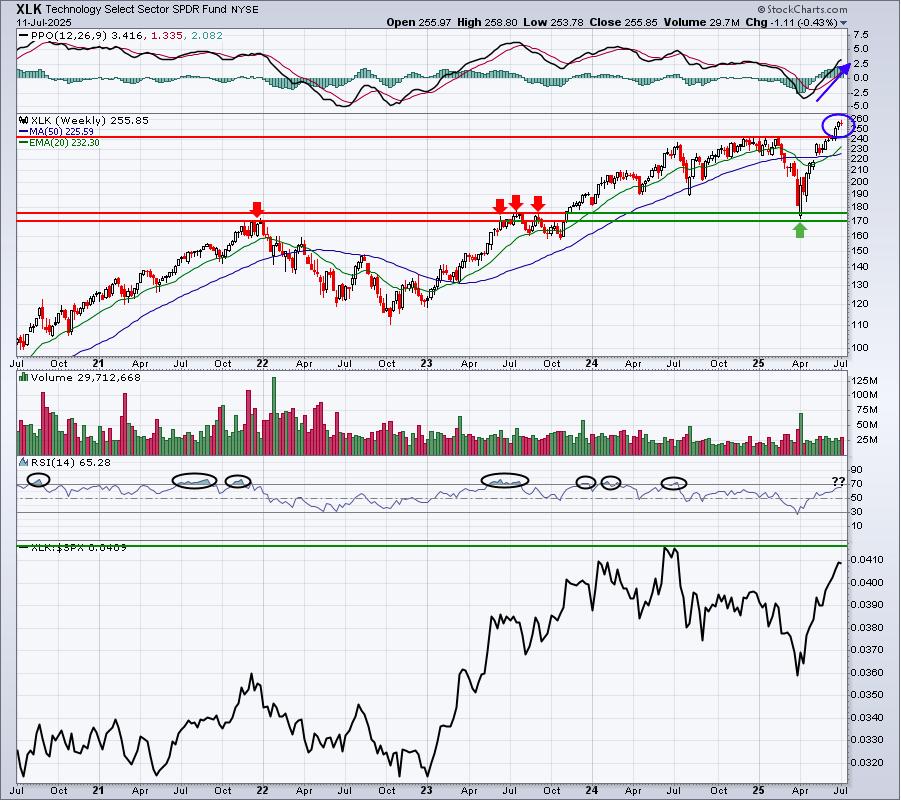

I remain very bullish and U.S. stocks have run hard to the upside off the April low with growth stocks leading the way. I expect growth stocks to remain strong throughout the summer months, as they historically do, but we need to recognize that they’ve already seen tremendous upside. Could technology (XLK) names, in particular, use a period of consolidation? Well, if we look at a 5-year weekly chart, the XLK really isn’t that overbought just yet:

The weekly PPO has crossed its centerline and is gaining bullish momentum. The recent price breakout suggests to me that we likely have further to run. And if you look at the weekly RSI, you’ll note that we’ve seen the weekly RSI move well into the 70s and even close to 80 before witnessing a market top or pause. Outside a bit of profit taking, I really don’t see the likelihood of a big selloff here. Keep in mind that the XLK represents 31% of the S&P 500. If the XLK doesn’t slow down, it’s very unlikely that we’ll see any type of meaningful decline in the S&P 500 either.

Growth vs. Value

Growth stocks have historically performed well over the summer months. One way to visualize this is to compare large-cap growth (IWF) to large-cap value (IWD) using a seasonality chart. Check this out:

The average monthly outperformance since 2013 is reflected at the bottom of each month’s column. If you add those numbers for May through August, you get +5.4%. If you add those numbers for the other 8 months combined, you get +0.6%. Clearly, large-cap growth has the tendency to outperform value from May through August. We’re in the growth “sweet spot” right now.

So Should We Lower Our Market Expectations?

I say absolutely not. Yes, we’ve run substantially higher off that April low, but I see more left in the tank. Will we see profit taking from time to time and could we see a period of consolidation? Sure. But I still believe that remaining on the sidelines is a big mistake as plenty of market upside remains. In fact, I see another somewhat forgotten asset class that’s poised to scorch 50% higher or more, possibly over the next 6 months. I’m investing in this area now, as I believe it’s in the early stages of a significant rally, and believe it would be prudent for you to take a look as well. For more information, simply CLICK HERE, provide your name and email address, and I’ll send you a video that explains exactly why I’m favoring this group right now!

Happy trading!

Tom